Global diversification in equities and bonds

We take a global approach to our asset class universe and believe portfolios should be geographically diversified for two main reasons:

- Financial markets are global in nature and we should try to access as many sources of return as possible. Different parts of the world have different growth drivers and risks, offering us a wide variety of investment opportunities. For example, to benefit from the innovative power of the world's largest technology companies, we need to include US equities in the portfolio. To take advantage of the fastest growing economy on the planet at present, we cannot ignore Chinese stocks. The list goes on. As these drivers are often not easy to identify in advance, the best approach is to include as many regions in the portfolio as possible.

- Asset classes across the globe are not perfectly correlated. For example, the performance of US equities is not perfectly in sync with the performance of European equities. This feature becomes especially relevant when local risks (think of Brexit or the euro crisis) predominantly weigh on a specific region's equity market. Therefore, having many different asset classes in the portfolio brings diversification benefits, whereby the risk of the overall allocation is lower than the sum of risk of the constituent parts.

You might prefer to invest in companies or regions you feel you know, even if that means giving up potential returns. Although it’s human nature to prefer what’s familiar, there’s a negative side effect beyond foregone performance — less well-diversified portfolios are often riskier and suffer larger drawdowns. Higher risk with similar (or even lower) returns is the very definition of inefficient portfolios.

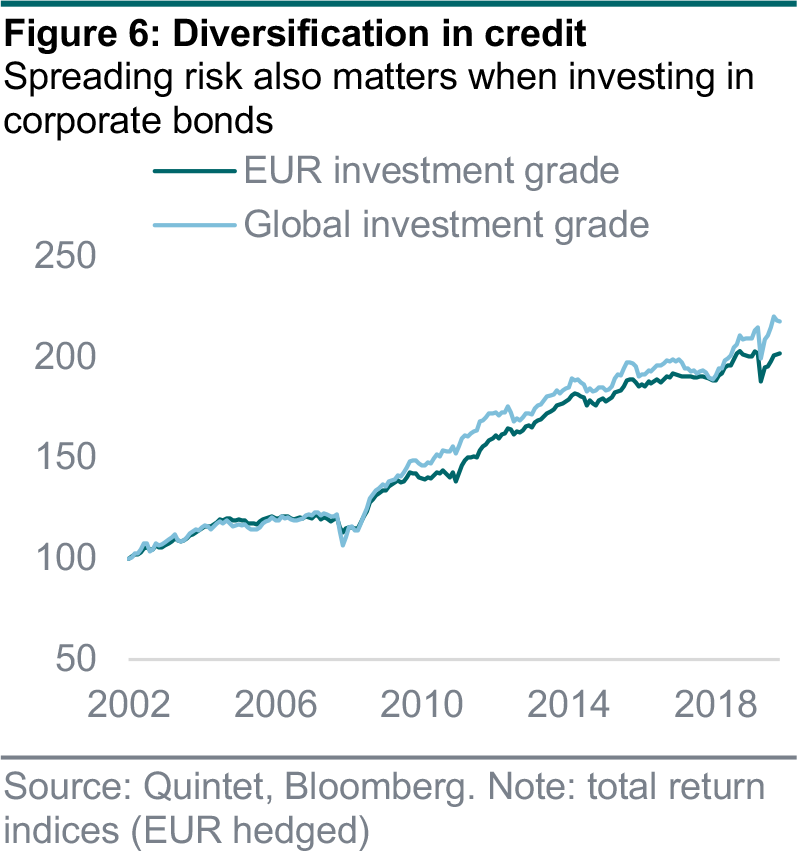

We see this happen with undiversified equity and bond exposures. For example, outsized allocations to European equities or corporate bonds achieved significantly worse risk-adjusted returns than global equities or credit over longer time periods (figures 5 and 6).

Our well-diversified SAAs help you overcome home bias and ultimately generate better results. If you still want to put a larger emphasis on a specific equity market, you can do so by allocating a smaller portion of your wealth to a dedicated stock portfolio, while keeping most of your investments in one of our SAAs.

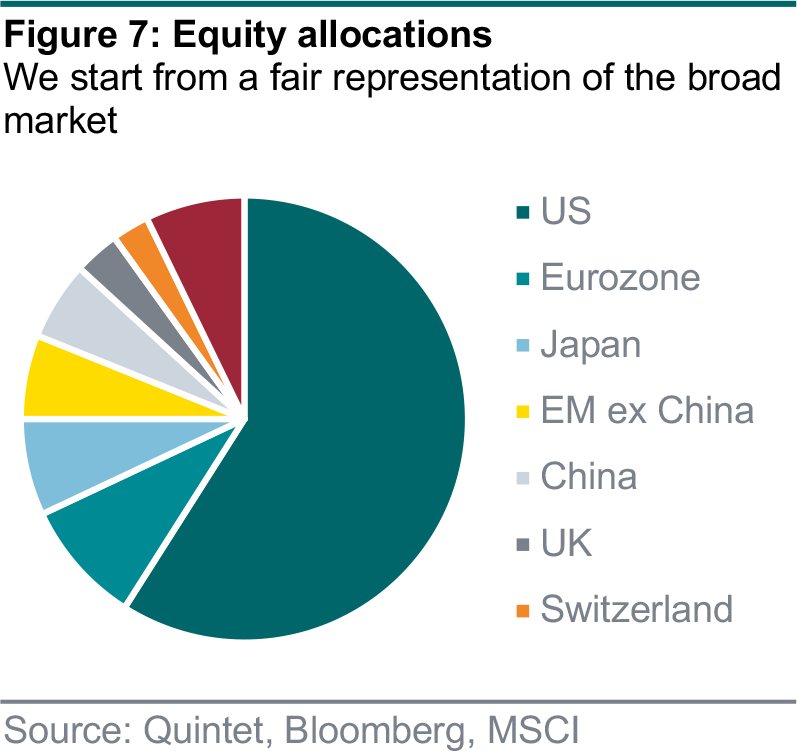

When constructing our SAAs we follow the principle of global diversification by taking the global market-cap weights of a given asset class (such as global equities) as a starting point. This ensures we start from a fair representation of the broad market, which evolves dynamically over time with the relative growth of the sub-markets (for example, US, European or Chinese equities).

We then run our CMA and optimizer models and check if there is material reason to deviate from the market-cap weights. Our most recent results led us to keep the regional equity allocation aligned to market-cap weights. Specifically, that means a larger allocation to US stocks than other regions (figure 7).

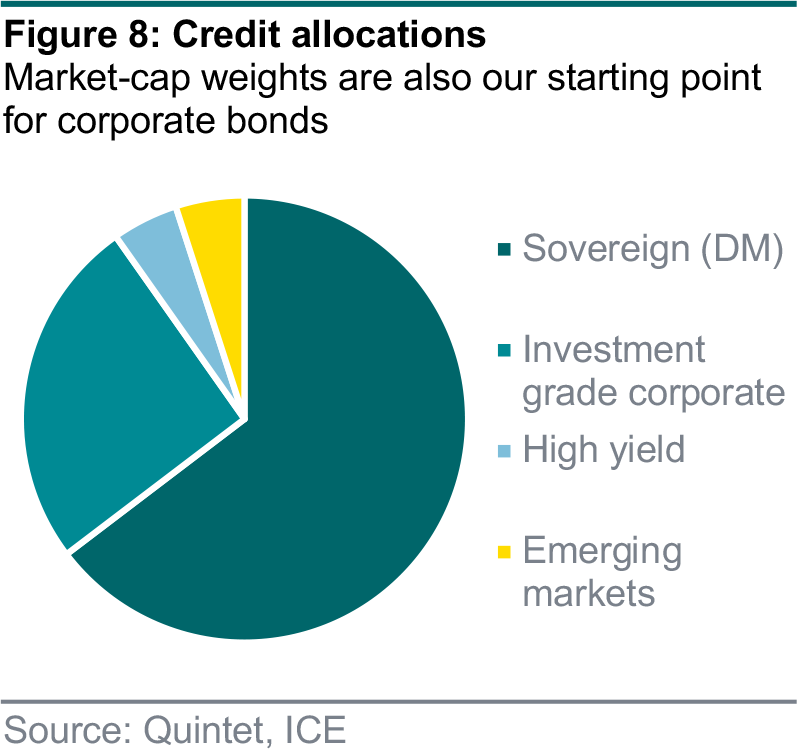

Within fixed income, we overweight global credit in our SAAs against its market-cap weight.

Developed market government bonds make up more than 60% of the global fixed income market (figure 8). But expected risk-adjusted returns for this sub-asset class are substantially lower than in the past and warrant a reduction in favor of more attractive credit sub-asset classes. We will explore this important topic in more detail in the next edition of this SAA series, to be published later in the month.