The fifth piece in a series exploring our approach to strategic asset allocation (SAA) looks back. In this inaugural edition of our biannual SAA performance review, we recap the first half of the year through the lens of our Quintet Group SAAs. How did they perform and what drove returns?

- Our Group SAAs are the most efficient risk-adjusted portfolios considering different levels of clients’ risk appetites. They are optimised over the long term on an index level. For our euro investors, the SAAs delivered positive performance across all risk profiles in the first half of the year.

- Taking risk paid off in the first half for those who could stomach the more pronounced ups and downs. Equities were the strongest contributor to the overall portfolio return, followed by lower-rated developed market credit. Gold, eurozone government bonds and US investment grade bonds fared less well.

- These traditionally more defensive assets detracted from portfolio performance in a ‘Goldilocks’ market environment but the negative performance was very much condensed in the first quarter of the year. However, for the long-term investor, high-quality bonds and gold offer undeniable value in a well-constructed portfolio.

Last year, we launched our new Quintet strategic asset allocations (SAA) to help our clients stay invested through good times and bad and reap the benefits form compounding returns over time. These SAAs define a set of long-term asset allocations to match different appetites for risk and return expectations and generate the most efficient portfolios from a risk-adjusted perspective.

They are forward looking and long term in nature – the time horizon for our strategic asset allocation is 10 years.

As we have crossed the half-year mark on the calendar, we take a moment to look at how these SAAs fared so far this year. Where are the returns coming from? Which asset classes have done particularly well and which ones haven’t had such a good time. The review focuses on our pure SAAs – we do not consider the impact of tactical positioning, instrument selection and fees.

After turbulent times for financial markets last year, the first half of 2021 was characterised by strong equity market returns. Equities across most of the globe and other ‘risky’ assets benefited from a strong economic recovery and continuing monetary and fiscal support amid residual risks surrounding new Covid variants. Safer assets, intended to provide ballast to portfolios during the bad times, unsurprisingly maybe fared less well. This market environment is reflected in our SAAs’ performance over the first half of the year.

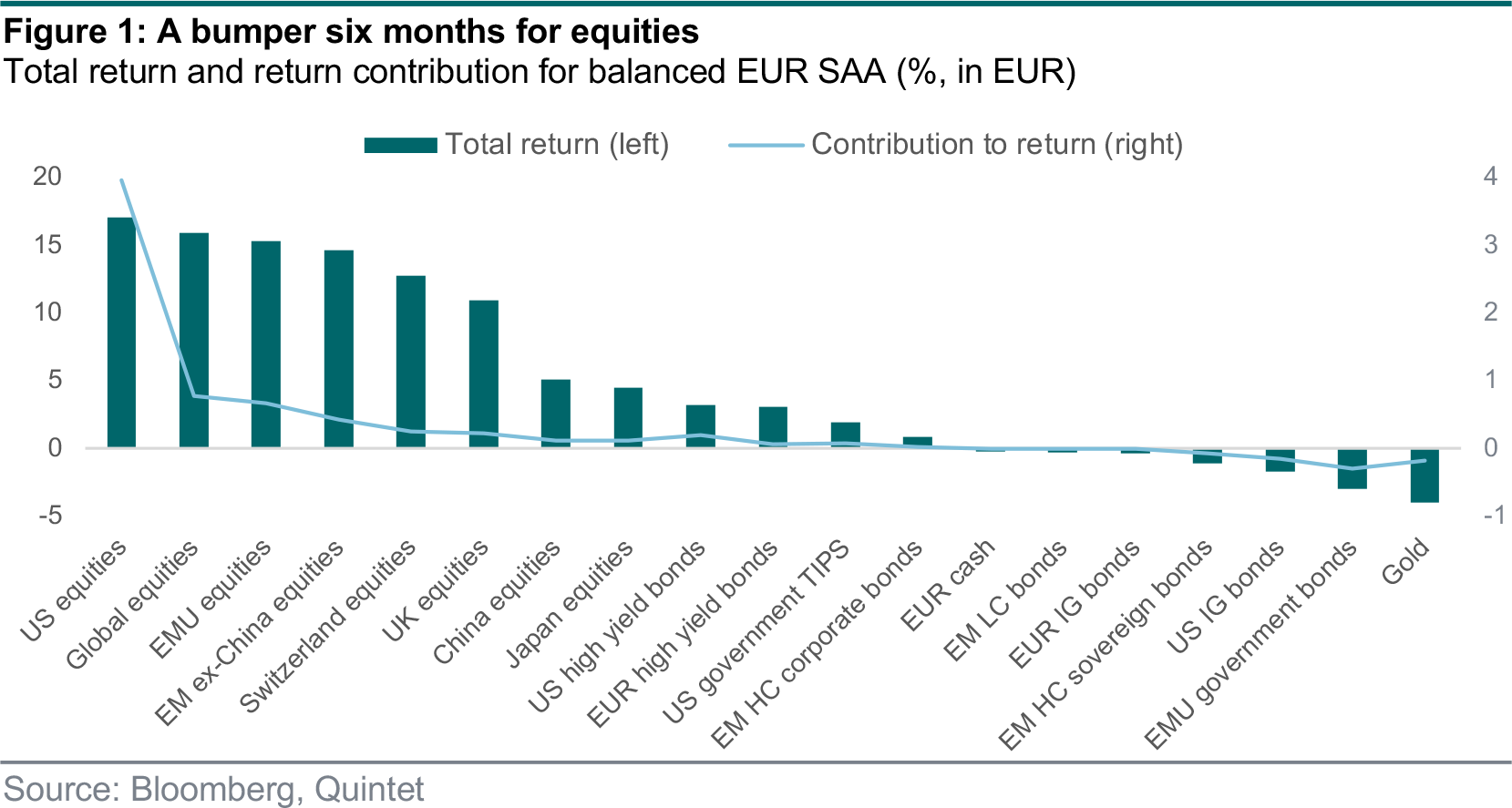

The strongest return contributor in our SAAs in the first half of the year were equities across the board, but especially US equities. The MSCI US market index (which we partially currency hedge) generated about two-thirds of the total return in our balanced EUR portfolios.

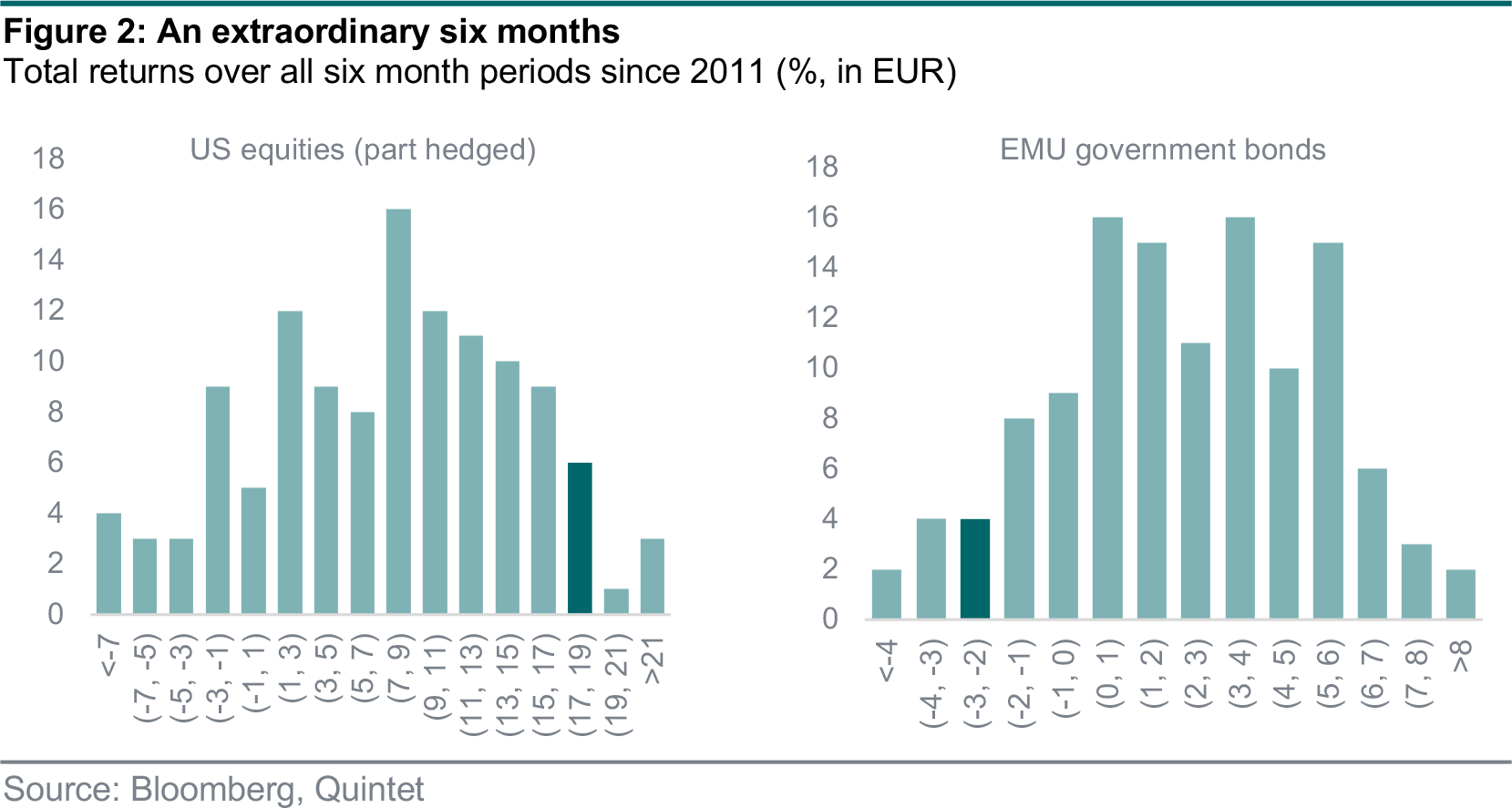

That is a result of the sizeable weight we put on US equities in our globally minded asset allocation. For example, in our balanced EUR SAA, nearly a fourth of the portfolio is allocated to US stocks, the largest single position. But the US stock market also experienced a bumper first half of a year. An investor allocating 1,000 EUR to the US equity market at the start of the year would have walked away with 1,171 EUR on the last day of June. It is the strongest first-half performance for US equity in the last 10 years, save for 2019. In fact, looking at any six-month period since 2011, only a handful have been better than the first six months of this year.

On the flip side, our exposure to gold, government bonds in the eurozone and investment grade credit in the US suffered. These traditionally more defensive asset classes tend to fare worse in a ‘Goldilocks’ market environment. That was certainly the case in the first half of 2021 when a combination of strong economic momentum and increased uncertainty about future inflation and central bank policy pushed yields of longer-dated bonds higher. But make no mistake. High-quality bonds and gold very much offer value in an optimal portfolio over the long term precisely because not all assets perform the same in changing market environments and correlations between asset classes can change quickly from one quarter to the next.

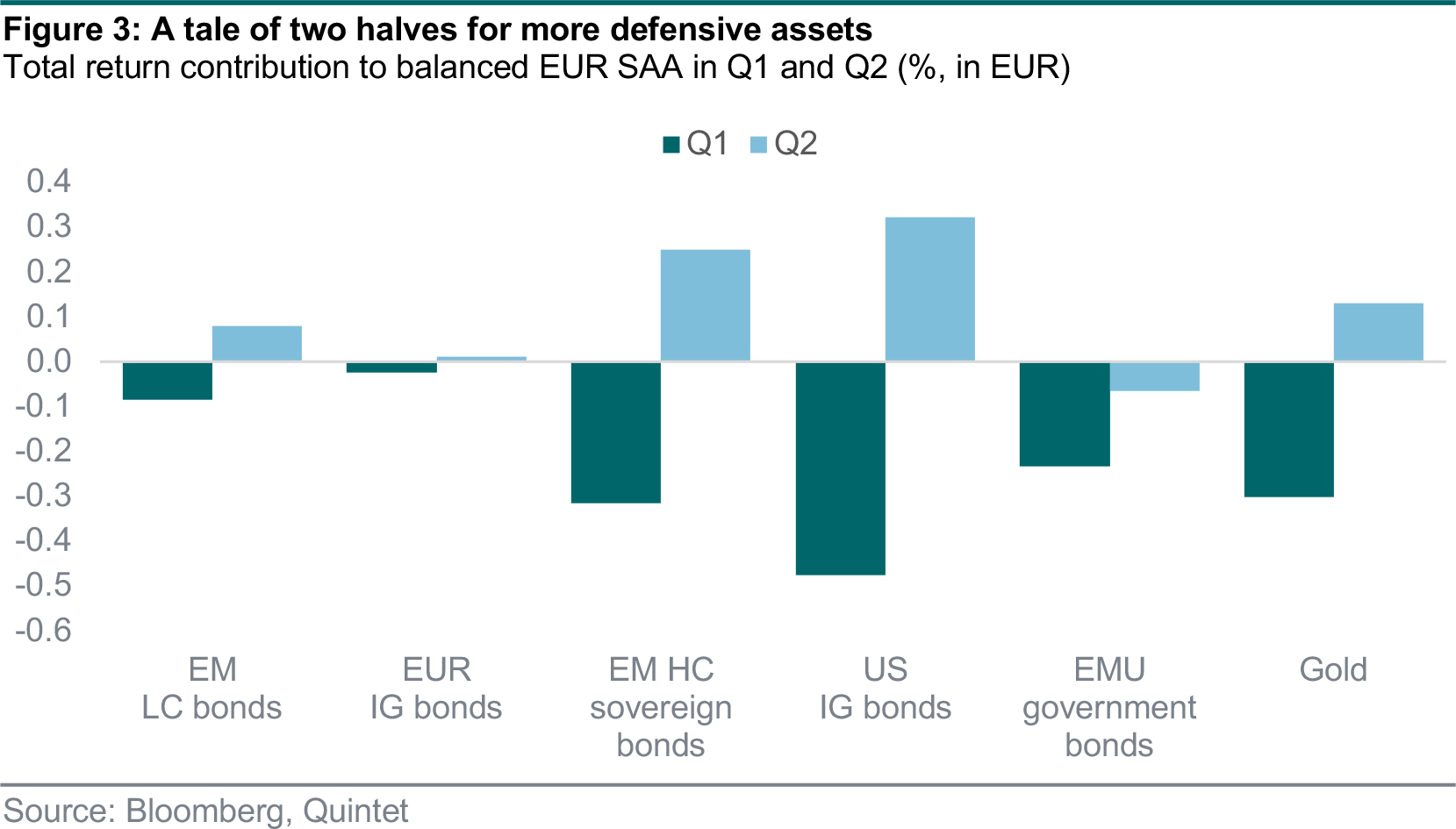

Looking at the six-month performance masks a bit that for some asset classes the first quarter had been quite different from the second one. While the contribution from equities was even-handed across most markets over the first two quarters, for some of these more defensive assets it’s been more of a tale of two halves.

The bottom five asset classes all detracted from the overall portfolio’s performance in the first half of the year. But all five fared significantly better in the most recent quarter than in the first of the year. Except for eurozone government bonds, they all rallied significantly in the second quarter and made back most of the historically bad first quarter performance. That’s been particularly the case for US investment grade bonds, which suffered the second-worst quarter in over 20 years in the first quarter. Over short periods of time, financial markets can be quite volatile and correlation between assets can change signs frequently.

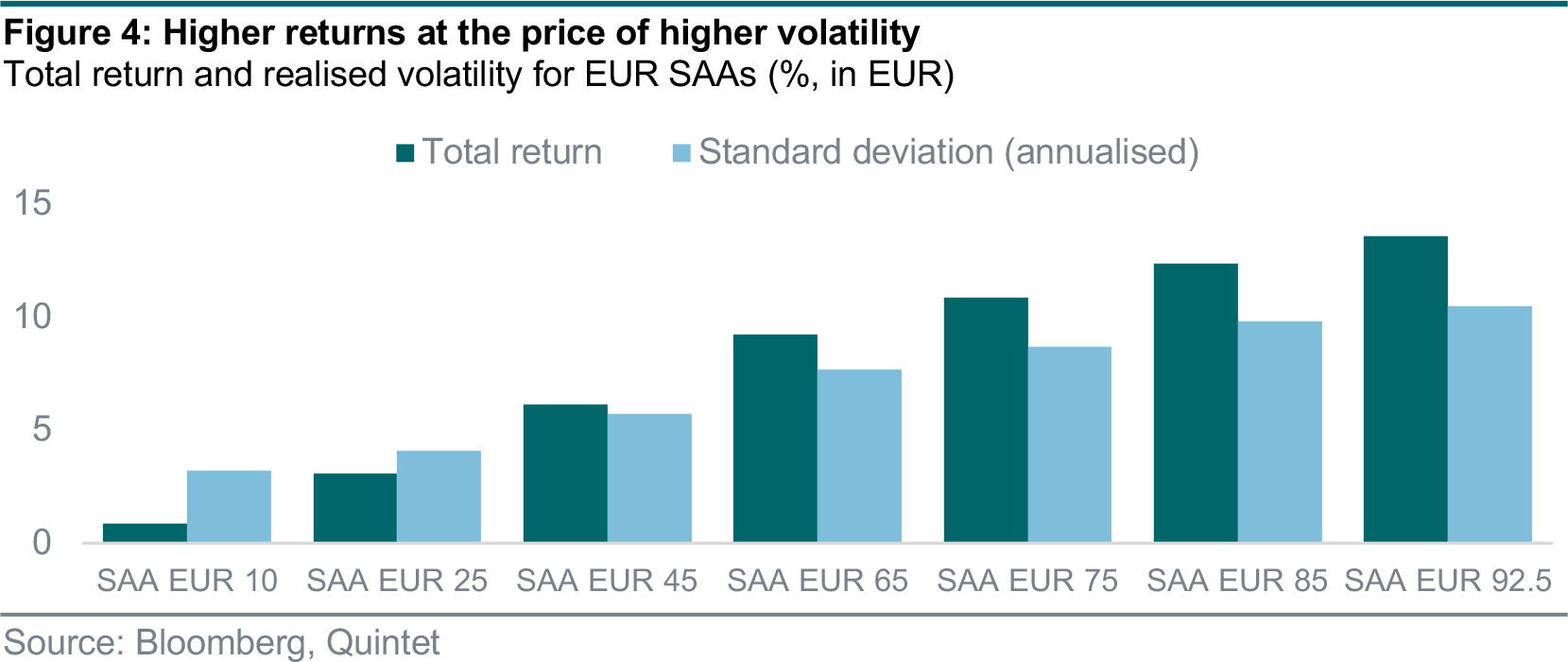

Higher returns tend to come at the price of higher risk. Not all our clients feel most comfortable with a balanced SAA that we focused on above. Some trade off lower expected returns for a particularly smooth journey. Others are better placed to endure a rollercoaster ride. The good news is that our EUR SAAs were in the black across all risk profiles (from the most conservative with an equity allocation of only 10% to the most aggressive one with 92.5% of the portfolio invested in equities). The riskier profiles, which are characterised by more sizable allocations to equities, have had stronger returns of the first half. For example, our balanced EUR SAA delivered just north of 6%; our riskiest profile, which is almost exclusively made up of equities, delivered just shy of 14%. The price investors in these portfolios had to pay over the first half of the year was higher volatility as the year so far unfolded. Very few things in life come free. It’s no different when investing.

With the benefit of hindsight, equities were the place to be in the first half of the year. Assets traditionally viewed as safer did not perform as well, particularly over the first quarter of the year. When we construct our SAAs, the time horizon we have in mind is a long one (we optimize over a 10-year horizon) and diversification remains a key pillar of our investment strategy. For good reason. We remain convinced that government bonds, high-quality corporate bonds and gold play a crucial role alongside riskier assets in well-diversified portfolios for long-term investors. It is because of their ability to outperform in times of market stress and because combined with riskier assets they provide a smoother journey for our clients for any given level of risk a client may feel comfortable with. After all, last year’s turbulences in financial markets proved that the second half of the year need not look anything like its first.

Authors:

Carolina Moura-Alves Group Head of Asset Allocation

Patrik Ryff Strategic Asset Allocation Strategist

Philipp Schöttler Cross-Asset Strategist

Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 5 July 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.